尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

Dear reader,

亲爱的读者,

I have just undertaken my first trip overseas since the start of the pandemic, flying from London to sunny Spain. It is a good vantage point from which to assess the state of the European travel industry.

我刚刚进行了疫情爆发以来的首次海外旅行,从伦敦飞往阳光明媚的西班牙。这是评估欧洲旅游业状况的一个良好视角。

While my journey was unaffected by cancelled flights, lost bags or lengthy queues, not every traveller has been so lucky. Customers and shareholders in Scandinavian Airlines (SAS) were at the front of the queue on Tuesday as the airline filed for bankruptcy protection. The restructuring would not have an impact on service levels, the company said. But a pilots’ strike, which was blamed for the urgent need to restructure, could affect up to 30,000 customers.

虽然我的旅行没有受到航班取消、行李丢失或排长队的影响,但并不是每个旅行者都能这么幸运。周二,斯堪的纳维亚航空公司(SAS)申请破产保护,顾客和股东排在了最前面。该公司表示,重组不会对服务水平产生影响。但飞行员罢工被认为是重组的迫切需要,可能会影响多达3万名客户。

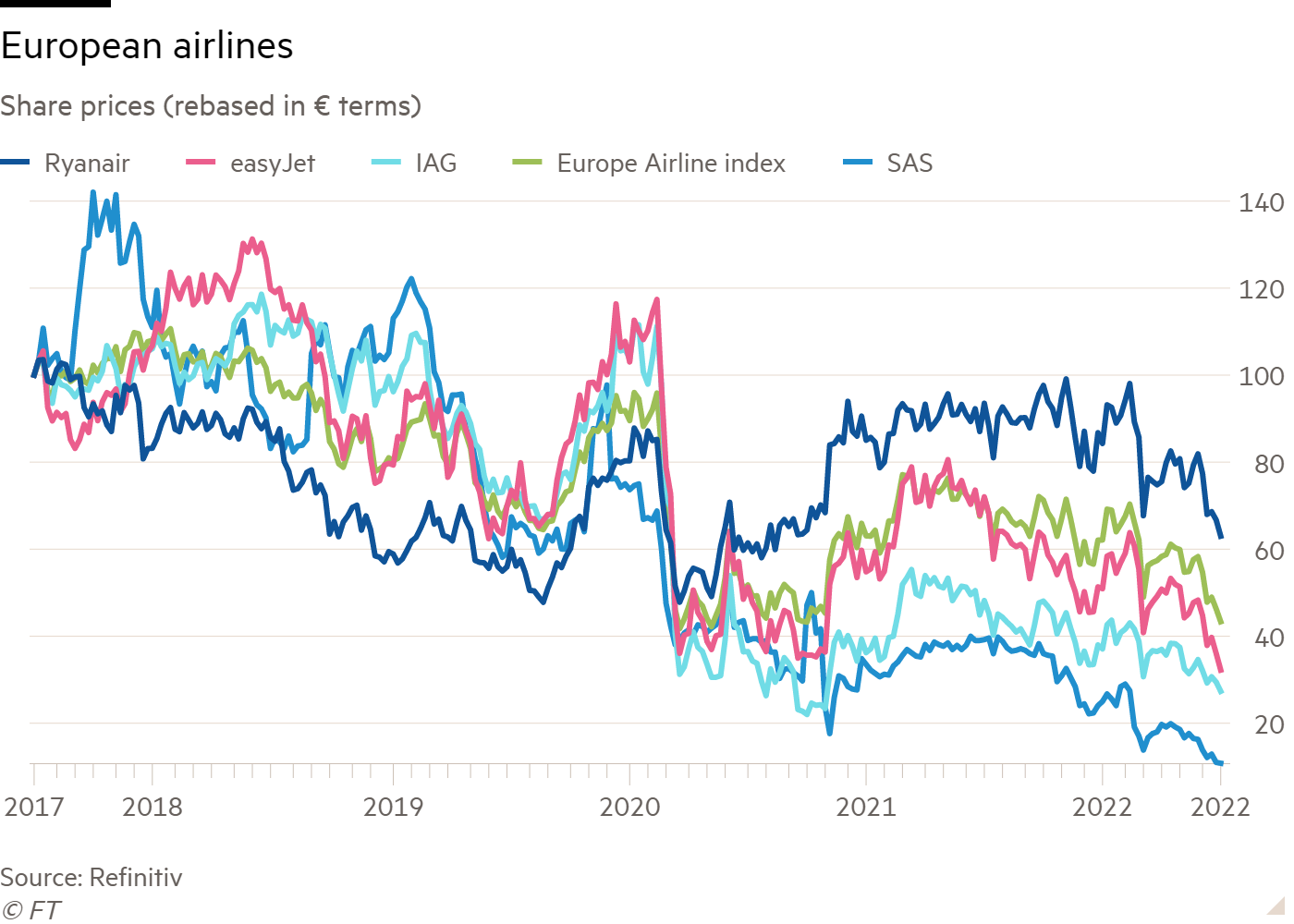

Shares in SAS fell as much as 14 per cent in response. That leaves the company’s equity valued at just under $400mn, down from almost $2bn a year ago.

SAS股价应声下跌14%。这使得该公司的股票价值略低于4亿美元,低于一年前的近20亿美元。

A sector that was previously hailed as one of the best ways to trade the pandemic recovery is going rapidly downhill.

一个此前被誉为大新冠疫情复苏最佳途径之一的行业,正在迅速走下坡路。

Customer demand is still high: pandemic-era travel restrictions have eased and travellers are booking holidays. In most countries (excluding China) passenger numbers have either returned to or surpassed 2019 levels. Bookings data suggest the trend will continue into the third quarter of the year.

客户需求仍然很高:疫情时代的旅行限制已经放松,旅行者正在预订假期。在大多数国家(不包括中国),乘客人数已恢复或超过2019年的水平。预订数据显示,这一趋势将持续到今年第三季度。

But for SAS pilots, British Airways’ ground crew and Ryanair’s cabin staff, the problem is pay. Airline staff who accepted cuts during the pandemic to help preserve jobs want to claw back those losses and be compensated for rising living costs.

但对于SAS飞行员、英国航空(British Airways)地勤人员和瑞安航空(Ryanair)的客舱工作人员来说,问题在于薪酬。在疫情期间接受裁员以保住工作的航空公司员工希望弥补这些损失,并获得生活成本上涨的补偿。

Along with higher wage bills, airlines are contending with more expensive fuel costs as the price of oil climbs. With interest rates rising, heavily indebted airlines must also consider the prospect of higher debt servicing charges.

随着油价的攀升,航空公司不仅要应对更高的工资,还要应对更昂贵的燃油成本。随着利率的上升,负债累累的航空公司还必须考虑更高的偿债费用的前景。

As part of its restructuring, SAS hopes to cut $716mn in costs. It will also raise about $900mn in new equity with further plans to swap or pay down almost $2bn of liabilities — about one-third of the total. An existing $741mn of cash on hand will help to smooth the process. The current consensus is that SAS will yield a small operating profit by 2024.

作为重组的一部分,SAS希望削减7.16亿美元的成本。该公司还将通过发行新股筹集约9亿美元资金,并计划进一步置换或偿还近20亿美元的债务——约占总负债的三分之一。现有的7.41亿美元现金将有助于这一过程的顺利进行。目前的共识是,SAS将在2024年之前实现少量运营利润。

Unlike AirFrance-KLM, which is undergoing its own $2.3bn state-backed rights issue, the Swedish and Danish governments have already ruled out contributing to an SAS rescue plan.

与法航-荷航正在进行23亿美元政府支持的配股不同,瑞典和丹麦政府已经排除了参与SAS救援计划的可能性。

Elsewhere, debt and equity fundraisings over the past two years have kept airline bankruptcies to a minimum. Airlines have largely been able to hold on to the cash that has been raised.

在其他地方,过去两年的债务和股权融资将航空公司破产率降到了最低。航空公司基本上能够保住筹集到的现金。

The latest cash balances at IAG, easyJet and Ryanair stood at €8bn, £3.5bn and €3.6bn respectively. If growing fears of a recession in Europe prove true, these will be needed — particularly in the stagflation scenario that many are expecting.

国际航空集团(IAG)、易捷航空(easyJet)和瑞安航空的最新现金余额分别为80亿欧元、35亿英镑和36亿欧元。如果对欧洲衰退的日益担忧被证明是真的,这些措施将是必要的——尤其是在许多人预期的滞胀情况下。

Airlines are only just expected to return to operating profit this year. Stress testing shows that interest cover for IAG and easyJet falls below expected operating earnings if interest costs double and ebit is one quarter less than current expectations.

预计航空公司今年才刚刚恢复营业利润。压力测试显示,如果利息成本增加一倍,且息税前利润比当前预期低四分之一,国际航空集团和易捷航空的利息覆盖将低于预期的营业利润。

A less indebted airline such as Ryanair would hold up better, with interest covered five times even in a stagflationary scenario. Along with better fuel hedges and growing market share, there is reason to think Europe’s best-performing airline will be able to hang on to its title.

像瑞安航空这样负债较轻的航空公司的情况会更好,即使是在滞涨的情况下,其利息也能得到5倍的补偿。加上更好的燃油对冲措施和不断增长的市场份额,有理由认为这家欧洲表现最好的航空公司将能够保住自己的头衔。

Fuel costs are already high and interest payments are likely to rise. Staffing overheads remain the only real lever for cost-conscious airlines. That does not bode well for shareholders or air passengers. Wish me luck for my return journey to London.

燃料成本已经很高,利息支付可能还会增加。对于注重成本的航空公司来说,人力成本管理仍然是唯一真正的杠杆。这对股东和乘客来说都不是什么好兆头。祝我回伦敦的路上好运。

Andrew Whiffin

Andrew Whiffin

Lex writer

Lex专栏作家

If you would like to receive regular updates whenever we publish Lex, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

如果您想在我们发布Lex专栏时定期收到更新信息,请将我们加入您的FT文摘,这样您就会在我们每次发布时收到即时的电子邮件提醒。您还可以通过网页查看每一个Lex专栏